UK payday loans

When financial emergencies strike, many people in the UK turn to payday loans for quick relief. But while they offer instant access to cash, the risks often outweigh the benefits. The good news is that there are safer and more reliable alternatives. From credit unions to budgeting apps, borrowers today have better short-term borrowing options. This article explores practical solutions to help you manage your money wisely and avoid falling into the payday loan trap.

Financial emergencies can happen to anyone. A car breakdown, an unexpected bill, or a sudden medical cost can leave you scrambling for cash. UK payday loans are the fastest solution for many. However, they come with high interest rates and a cycle of debt that is hard to escape. The good news is that there are safer, more sustainable ways to access money when you need it.

In this article, we’ll explore the most effective alternatives to payday loans in the UK, how they work, and why they are better options for your financial health.

Why Avoid Payday Loans?

Payday loans promise quick money, but they come at a heavy price. Interest rates can be eye-watering, often reaching levels that make repayment almost impossible. Missing a payment may trigger extra fees and push borrowers deeper into debt.

According to the Financial Conduct Authority (FCA), stricter regulations have reduced the worst practices in the payday loan sector, but risks remain. Borrowers remain vulnerable to high costs, particularly when loans are rolled over.

This is why exploring safer alternatives is essential.

Credit Unions

Credit unions are not-for-profit organisations owned by their members. Unlike payday lenders, they focus on community support rather than profit.

- Affordable Rates: Credit unions offer lower interest rates compared to payday lenders.

- Flexible Repayments: Payments are often tailored to your circumstances.

- Member Support: Many unions provide financial education and savings schemes.

If you are eligible, joining a credit union could give you access to small, affordable loans without the stress of mounting debt.

Overdraft Facilities

Many banks offer authorised overdrafts that can be a safer option than payday loans.

- Regulated Costs: Since 2020, overdraft charges have been simplified, with most banks charging interest instead of confusing fees.

- Flexibility: Overdrafts can cover minor shortfalls in your account.

- Quick Access: Money is available instantly.

However, overdrafts should be used for short-term borrowing only. Prolonged reliance can lead to higher costs over time.

Personal Loans from Banks or Online Lenders

If you need to borrow more and can repay over a few months, a personal loan is often a better option.

- Fixed Interest Rates: You know exactly how much you’ll repay.

- Structured Repayments: Payments are spread out, avoiding sudden financial pressure.

- Larger Borrowing Limits: Suitable for emergencies like home repairs or medical costs.

While approval may take longer than payday loans, personal loans are safer and more affordable.

Employer Salary Advances

Some employers now offer salary advance schemes, allowing employees to access a portion of their wages before payday.

- No Interest: Usually, only a small processing fee applies.

- Quick Access: Money is available when needed most.

- Employee Benefit: Helps reduce financial stress at work.

Check if your employer provides this option. It can be a cost-effective way to handle short-term needs.

Community and Government Support

Local councils, charities, and government-backed schemes often provide financial help in times of crisis.

- Grants: Some councils offer emergency assistance that doesn’t need repayment.

- Debt Advice Services: Free resources can help you manage bills.

- Food Banks and Vouchers: For immediate needs, support services are widely available.

Exploring these before borrowing money can ease pressure without adding new debt.

Peer-to-Peer Lending

Peer-to-peer (P2P) platforms connect borrowers directly with investors.

- Competitive Rates: Often lower than payday loans.

- Online Convenience: Applications are quick and straightforward.

- Transparent Process: Platforms are regulated for fairness.

Though not risk-free, P2P lending can be more affordable than high-cost borrowing.

Budgeting Apps and Financial Tools

Sometimes, the best alternative to borrowing is better money management.

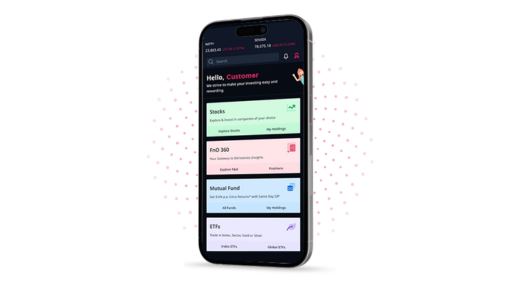

- Apps like Monzo or Revolut: Provide real-time spending insights.

- Budget Planners: Help you track expenses and avoid overspending.

- Savings Features: Round-up tools save small amounts automatically.

These tools don’t provide instant cash but can prevent the need for emergency borrowing in the first place.

Using a Credit Card Wisely

Credit cards are often frowned upon, but when used carefully, they can be a cheaper short-term option.

- 0% Interest Offers: Some cards offer interest-free borrowing for several months.

- Flexibility: You only borrow what you need.

- Rewards: Cashback or points may add extra value.

The key is discipline—repay in full or stick to manageable instalments.

Debt Consolidation

If payday loan debt is already a burden, debt consolidation might help.

- Single Monthly Payment: Easier to manage.

- Lower Interest: Compared to multiple payday loans.

- Stress Reduction: A clear path toward financial stability.

Working with a financial advisor can help you choose the best consolidation option.

Why Safer Options Matter

At the heart of the problem is reliance on UK payday loans, which often create more challenges than they solve. By considering safer alternatives, borrowers can protect their finances and mental well-being.

Short-term financial gaps are part of life, but how you handle them makes all the difference. Choosing responsible lending options ensures you get the support you need without falling into long-term debt traps.

Final Thoughts

Life is unpredictable, and financial emergencies can’t always be avoided. But turning to payday loans is not the only choice. By exploring the alternatives highlighted above, you can find safer, more reliable, and less stressful ways to handle short-term financial pressures.

Making informed decisions today will protect your financial future tomorrow.