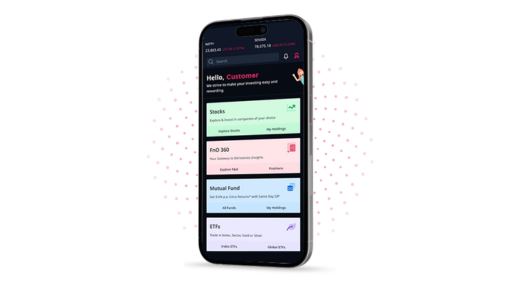

Online trading app

Understanding the Basics of Commodity Trading

Commodity trading involves the buying and selling of raw materials or primary agricultural products such as gold, oil, wheat, and corn. These items are traded on exchanges worldwide, where investors can speculate on their future prices. The prices of commodities are influenced by various factors such as supply and demand, geopolitical events, weather conditions, and market sentiment.

While commodity trading can be lucrative, it also comes with its risks. Investors need to carefully analyze market trends and do thorough research before entering the commodity market. Understanding the basics of commodity trading is essential for making informed decisions and maximizing profits. By monitoring price fluctuations, staying informed about global events, and implementing risk management strategies, investors can navigate the complexities of commodity trading successfully.

Commodity Recommendation Commodity trading involves buying and selling raw materials like gold, oil, wheat, and corn on global exchanges. Prices are influenced by supply, demand, geopolitical events, weather, and market sentiment. To succeed, investors must analyze trends, research, monitor prices, stay informed, and manage risks effectively.

The Role of Commodities in the Global Market

Commodities play a crucial role in the global market due to their inherent value and the essential nature of raw materials in everyday life. These tangible assets, such as agricultural products, energy sources, and metals, form the building blocks of economies worldwide. As the demand for commodities fluctuates based on various factors like geopolitical events, weather conditions, and technological advancements, they often serve as indicators of economic health and market trends.

In addition to being essential for daily consumption, commodities also act as a key component of international trade and investment. The global market relies on the trading of commodities to facilitate economic activities across borders, with prices reflecting the supply and demand dynamics of different regions. The exchange of commodities not only influences economic growth but also fosters interconnectedness among nations, shaping the overall landscape of the global economy.

Advantages of Diversifying into Commodities

Commodities offer investors a unique opportunity to diversify their portfolios beyond traditional stocks and bonds. By adding commodities to their investment mix, individuals can hedge against inflation and other economic uncertainties. The low correlation of commodities with other asset classes means that they can potentially provide better portfolio diversification and risk management.

Furthermore, investing in commodities can offer protection against geopolitical risks and market volatility. As commodities are tangible assets with intrinsic value, they can act as a store of value during times of economic instability. This asset class has the potential to provide attractive returns over the long term, making it an appealing option for investors looking to enhance the resilience and performance of their investment portfolios.

Factors Influencing Commodity Prices

One of the key factors that can influence commodity prices is supply and demand dynamics. When the demand for a particular commodity outweighs its supply, prices tend to rise as buyers compete for limited resources. Conversely, if the supply of a commodity exceeds its demand, prices may fall as sellers lower prices to attract buyers.

Another critical factor affecting commodity prices is geopolitical events and economic data releases. Political instability, trade tensions, natural disasters, and government policies can all impact the prices of commodities by disrupting supply chains, creating uncertainty in the market, or affecting market sentiment. Additionally, economic indicators such as GDP growth, inflation rates, and interest rates can provide insights into the health of the economy, which in turn influences the demand for commodities.

Stocks Recommendation are essential in guiding investors on potential investments. Factors influencing commodity prices include supply and demand dynamics, geopolitical events, and economic data releases. Political instability, trade tensions, and economic indicators all play a crucial role in determining commodity prices.

Different Types of Commodity Investments

Commodity investments can be broadly categorized into physical commodities and commodity futures. Physical commodities include tangible assets like precious metals, agricultural products, and energy resources. Investors can purchase these commodities directly or indirectly through exchange-traded funds (ETFs) or mutual funds that track the prices of these physical commodities. On the other hand, commodity futures involve the trading of contracts to buy or sell a particular commodity at a predetermined price on a future date. These futures contracts provide investors with exposure to price movements without needing to physically own the commodity.

Another common type of commodity investment is through commodity options. Options give investors the right, but not the obligation, to buy or sell a commodity at a specified price within a set timeframe. This allows for greater flexibility and leverage compared to directly trading commodities or futures. Additionally, commodity-focused stocks or shares in commodity-producing companies are another way for investors to gain exposure to the commodities market. By investing in these companies, investors can benefit from the performance of the commodity without directly trading it.

Managing Risks in Commodity Trading

Commodity trading involves inherent risks that can significantly impact investment outcomes. To effectively manage these risks, it is crucial for traders to conduct thorough research and analysis before making any trading decisions. By understanding the market dynamics, supply and demand factors, geopolitical events, and market sentiment, traders can make more informed decisions and minimize potential risks.

Another key aspect of risk management in commodity trading is diversification. By spreading investments across different commodities, sectors, or regions, traders can reduce their exposure to specific risks associated with individual commodities. Diversification can help mitigate the impact of adverse price movements in one commodity on the overall portfolio, providing a more balanced and resilient investment strategy.

The Relationship Between Commodities and Inflation

Commodities and inflation share a complex relationship that is often intertwined. Historically, commodities have been seen as a hedge against inflation due to their tangible nature and ability to retain value during times of currency depreciation. As inflation erodes the purchasing power of fiat currencies, investors often turn to commodities such as precious metals, agricultural products, and energy resources to safeguard their wealth.

The prices of commodities are directly impacted by inflation rates, as a rise in inflation typically leads to an increase in commodity prices. This is because higher inflation levels often indicate strong demand for goods and services, which in turn drives up the prices of raw materials and other commodities. Additionally, during periods of high inflation, central banks may implement loose monetary policies, further fueling demand for commodities as investors seek alternative assets to protect themselves against the devaluation of currency.

Descending triangle pattern, with a hyperlink to more information on the topic, commodities and inflation are intricately connected. Commodities act as a hedge against inflation, retaining value during currency depreciation. Inflation directly impacts commodity prices, rising inflation leading to increased commodity prices due to higher demand.

Strategies for Successful Commodity Investing

To succeed in commodity investing, it is essential to conduct thorough research and stay informed about market trends. By staying up-to-date with global events and understanding how they impact commodity prices, investors can make more informed decisions. Additionally, having a diversified portfolio that includes a variety of commodities can help mitigate risks and maximize potential returns.

It is crucial for investors to set clear investment goals and develop a well-defined strategy before entering the commodity market. Establishing risk management techniques and adhering to a disciplined approach can help navigate the volatility often associated with commodity trading. By staying disciplined, informed, and proactive in their approach, investors can increase their chances of achieving success in the commodity market.

Key Considerations for Choosing Commodity Investments

When considering commodity investments, one key consideration is the level of volatility associated with a particular commodity. Some commodities, such as precious metals, can be relatively stable in terms of price fluctuations, while others, like agricultural products, can experience significant price swings due to factors such as weather conditions and geopolitical events. Understanding the volatility of a commodity is crucial in managing risk and determining its suitability for your investment portfolio.

Another important factor to consider when choosing commodity investments is the supply and demand dynamics of the market. Supply disruptions or changes in demand can have a significant impact on commodity prices. It’s essential to research and analyze the factors driving supply and demand for a particular commodity to make informed investment decisions. Additionally, considering the global market trends and economic conditions that can influence supply and demand for commodities is vital for predicting potential price movements in the future.

Online trading app offers a convenient platform for choosing commodity investments. Understanding commodity volatility and market supply and demand dynamics are crucial for managing risk and making informed investment decisions. Researching global market trends and economic conditions is essential for predicting potential price movements.

The Future Outlook for Commodity Markets

The future of commodity markets is subject to various factors that may shape their direction in the coming years. Global economic conditions, geopolitical events, technological advancements, and shifts in consumer preferences are all key elements that could influence commodity prices and demand. As the world continues to evolve, commodity markets are likely to witness ongoing fluctuations that require investors to stay informed and adaptable in order to navigate the uncertainties ahead.

Moreover, sustainability concerns and environmental regulations are increasingly impacting the commodity markets, leading to a growing emphasis on ethically and environmentally conscious practices. In response to these trends, commodities with a focus on sustainability, such as renewable energy sources and eco-friendly production methods, are expected to gain traction in the market. Investors who integrate these considerations into their commodity strategies may be better positioned to seize opportunities and mitigate risks in the evolving landscape of commodity trading.